Gracex Reviews: What You Need Before Opening an Account

“Gracex Reviews: What You Need Before Opening an Account” sets an important expectation — that traders should be fully informed before joining this platform. But does Gracex meet modern standards for cost, transparency, and service? Let’s explore what matters most before you decide to register.

Understanding Gracex’s Legal and Regulatory Setup

Gracex operates under the oversight of the Union of Comoros (Anjouan) with regulatory license L15817/GL. This includes the use of segregated client accounts and full compliance with global KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols.

While this is not Tier-1 regulation like the FCA or ASIC, it still offers legal clarity and operational structure. For users prioritizing fund protection and compliance, this is a vital foundation. It’s one of the legal aspects you must understand before opening an account with Gracex.

Gracex Account Types: Built for Different Needs

The broker offers a tiered account structure designed to accommodate all user profiles:

- FREE: Entry-level, with no commissions and up to $500 equity. Ideal for beginners or demo-to-live transitions.

- ZERO: Monthly fee of $100 with 0.0 pip spreads. Best for frequent traders who benefit from low-cost, high-volume execution.

- FIX: Fixed spreads from 3 pips. This account gives predictable costs — great for EAs and news traders.

- CENT: Trades from just $10 per lot. Perfect for micro-investing, testing strategies, or cautious progression.

Each option balances fees, spread structure, and trading style — crucial info you’ll need before opening an account with Gracex.

Trading Conditions: Real Cost Transparency

Gracex positions itself as a cost-efficient broker. Key metrics include:

- Spreads from 0.00 pips

- 0% commissions on most trades

- No swaps on overnight positions

- Pure STP execution (no dealing desk)

This structure means you pay only the spread — and in many cases, it’s essentially zero. Combined with access to Tier‑1 liquidity providers (UBS, Bank of China, CITI, HSBC), slippage is reduced and orders are filled without conflict of interest.

When evaluating brokers, these are the exact cost mechanisms you must understand before opening an account.

Trading Platform: MetaTrader 5 Across Devices

Gracex offers MetaTrader 5 (MT5) — a multi-asset, high-speed trading terminal with access through:

- WebTrader: Browser-based access

- iOS/Android apps: On-the-go trading with full toolsets

- Desktop client: Full performance, algorithmic trading, deep analytics

Users can run Expert Advisors (EAs), custom indicators, and advanced charting tools. The MT5 environment is known for stable execution and flexibility — one of the best platforms available in retail trading.

MT5 is a major part of what you’ll interact with daily — something you should be familiar with before opening an account with Gracex.

What Can You Trade on Gracex?

Asset availability includes both mainstream and niche options:

- Forex: Major (EUR/USD), minor (AUD/CAD), and exotic (USD/TRY, USD/ZAR)

- Indices: Global stock indices across continents

- Metals: Gold, Silver, Platinum

- Energy: Brent, WTI, Natural Gas

- Crypto: Bitcoin, Ethereum, Ripple, more

- Regional CFDs: Asia, EU, US, Russia, and Latin America

For traders aiming to diversify or hedge, this cross-asset support is a clear advantage. These are essential options to consider before you open an account.

Growth and Awards: What the Industry Says

In 2024, Gracex received two major industry recognitions:

- Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

These aren’t vanity metrics — they reflect rapid adoption and strong client servicing. For a relatively new player in the brokerage world, these awards indicate both user trust and operational maturity.

Growth and service are key parts of what you need to evaluate before opening an account with Gracex.

Extra Features for a Smoother Start

Gracex complements its trading offering with several add-ons:

- Copy Trading: Mirror strategies from experienced traders

- Social Trading: Tap into community activity and crowd sentiment

- PAMM Accounts: Let professionals manage your funds transparently

- Education Center: Webinars, market analysis, and tutorials for all levels

- Welcome Bonuses: Available based on account type and promotions

These tools support users at different levels — especially useful if you’re just starting or unsure how to proceed after registration.

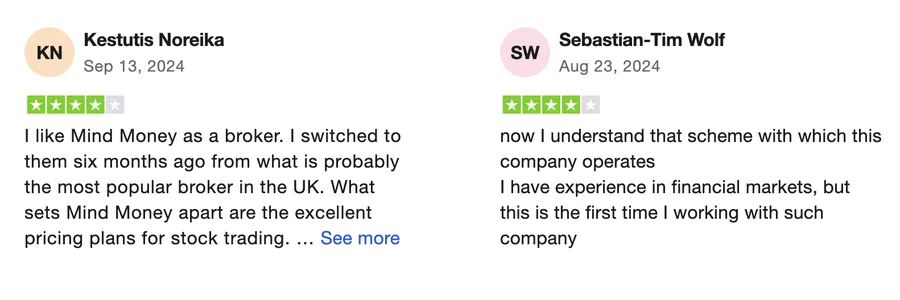

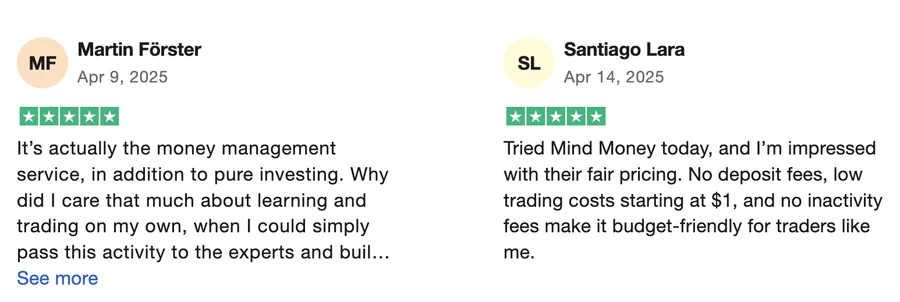

Reputation Review: What Users Are Saying

Gracex has built a visible reputation across platforms like Trustpilot, SiteJabber, and specialized forex forums. Recurring positives include:

- Transparent pricing (especially ZERO account)

- Quick support response

- Good MT5 performance under load

Reported negatives include:

- Geo-limited access to some bonus programs

- License not from Tier‑1 regulator

Still, in the context of global retail brokers, Gracex rates positively in user-driven communities — crucial insight before you sign up.

Final Verdict: Is It True That Gracex is Ready for New Users?

Yes — with some considerations. If your focus is on trading execution, ultra-low costs, and platform depth, Gracex delivers. However, if your priority is top-tier regulation, you may want to diversify your broker exposure or begin with a lower-risk account like FREE or CENT.

Checklist: What You Need Before Opening an Account

- ✅ Understand the differences between account types (FREE, ZERO, FIX, CENT)

- ✅ Test MT5 via demo to get a feel for execution and analytics

- ✅ Review spread vs. commission trade-offs

- ✅ Decide whether you’ll benefit from Copy or Social Trading tools

- ✅ Check your region’s eligibility for promotions or PAMM access

Gracex offers a complete package — but knowing how it works before you join will make all the difference.

No Comment