Gracexfx.com Reviews: Tips and Feedback from Traders

Is Gracex just another zero-spread broker — or a game-changer for modern trading? That’s the underlying question behind many Gracexfx.com reviews in 2025. This article explores how the broker’s claims — from 0.00 pip spreads to advanced automation and award-winning support — measure up in real trading conditions, based on trader feedback, execution stats, and platform tools.

What Gracex Offers (and What Traders Actually Get)

Gracex operates under license L15817/GL from the Union of Comoros (Anjouan). While not a Tier-1 regulatory jurisdiction, it does enforce KYC/AML standards and requires segregated client funds. For most traders, this covers the basic need for compliance and fund safety — though some risk-aware users may still prefer brokers under EU or UK oversight.

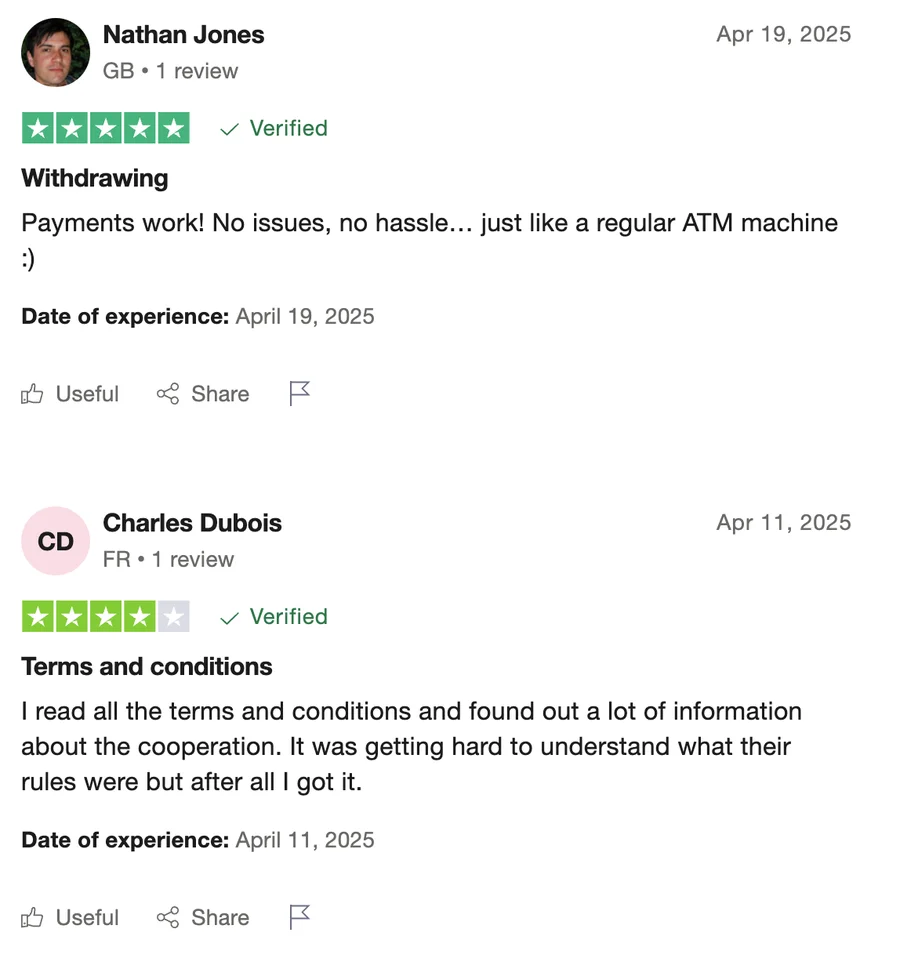

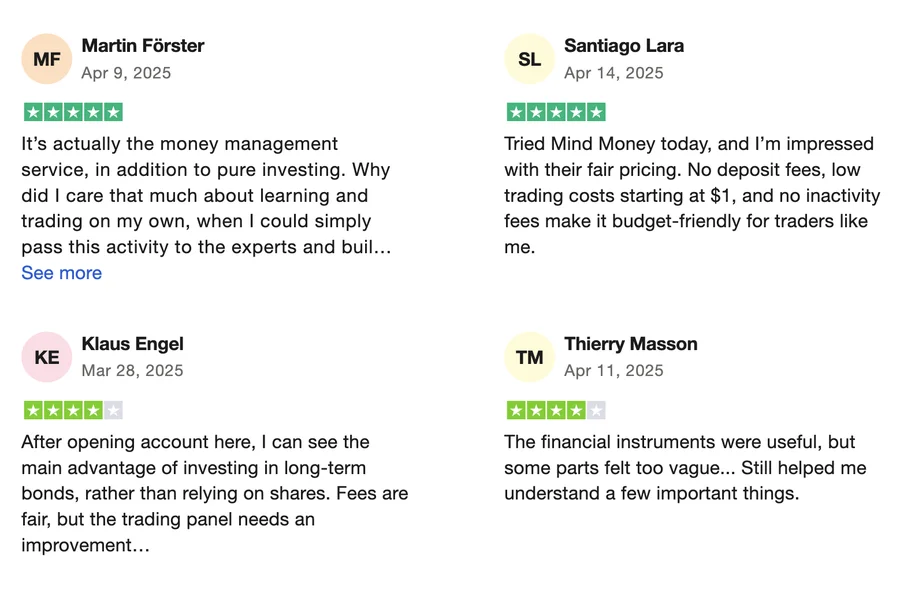

According to user discussions on platforms like Trustpilot, Reddit, and niche Forex forums, the regulatory aspect rarely comes up as a dealbreaker, especially due to Gracex’s visible customer support and fast response times.

So, how does this relate to the title? Simply put — many Gracexfx.com reviews confirm the broker holds up on safety and transparency, but it’s the daily trading performance that matters most.

MT5 Infrastructure: Stability, Speed, and Tools

Gracex runs entirely on the MetaTrader 5 ecosystem. The suite includes:

- WebTrader (browser-based, no download)

- iOS/Android mobile apps for on-the-go trading

- PC client with full automation, strategy testing, and indicators

Platform uptime and order stability score highly in independent trader feedback. Even with algorithmic bots running during high-volatility periods (e.g., NFP releases), there’s minimal slippage or freezing. Fast order routing through pure STP execution — directly to Tier-1 liquidity providers like HSBC, UBS, Citibank, Bank of China — ensures that traders see the real market, not a filtered desk version.

It’s this tight execution environment that many Gracexfx.com reviews identify as a key strength — especially for scalpers and EA users.

Cost Breakdown: Zero Spreads and 0% Commissions in Practice

The broker’s “0.00 spreads and zero trade commissions” promise is appealing — but context matters. Here’s a simplified example for a EUR/USD 1-lot trade (100,000 units):

| Account Type | Spreads | Commission | Fixed Fees | Estimated Cost |

|---|---|---|---|---|

| FREE | ~1.2 pips avg | 0% | $0 | $12 per trade |

| CENT | ~1.5 pips | 0% | $10/lot | $25 total |

| ZERO | 0.0–0.2 pips | 0% | $100/month | $2/trade (if high volume) |

| FIX | 3 pips (fixed) | 0% | $0 | $30 per trade |

Clearly, the ZERO account is optimal for high-frequency traders who can justify the monthly fee. FREE and CENT are better for testing and low-volume positions, while FIX suits those who prefer predictable costs.

These numbers are often quoted in Gracexfx.com reviews as evidence that all-in costs can be extremely low — but only if you choose the right account model.

Who Is Gracex Really For?

The company describes itself as a “tech-driven broker reshaping outdated structures.” And from the lineup of features, that claim isn’t empty:

- Copy Trading: Auto-mirroring of top-performing traders

- Social Trading: Follow and interact with strategy creators

- PAMM Accounts: Passive investing with verified portfolio managers

- Education: Tiered content for beginners to pros

- Analytics: In-platform insights, signals, economic calendars

- Bonuses: Varying by deposit and trading volume

These features create a well-rounded environment — not just for speculators, but for strategy builders, learners, and passive investors alike.

This diversity of use cases often shows up in positive Gracexfx.com reviews — especially from new traders and those transitioning from outdated platforms.

Recognition and Reputation: Awards and Peer Validation

In 2024, Gracex was awarded:

- Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

This recognition is echoed in user feedback praising the speed of KYC approvals (often under 6 hours), 24/5 multilingual support (including live chat and Telegram), and proactive onboarding materials.

These reviews support the idea that Gracexfx.com doesn’t just promise — it delivers a genuinely user-oriented support structure.

Gracexfx.com Reviews Recap: Is It All Hype or Real Value?

Let’s revisit the core claims with a checklist:

- Low-cost trading: TRUE for the ZERO account; variable for others

- Platform performance: TRUE, especially with MT5 PC client

- Execution transparency: TRUE (pure STP, no dealing desk)

- Educational value: TRUE for early-stage and passive users

- Offshore regulation: TRUE, but limits appeal for some

Final verdict: Gracex delivers real value, especially when traders match their volume and goals with the right account type. It’s not “perfect,” but it’s more than just a well-marketed name — and that’s a consistent message in Gracexfx.com reviews.

Next Steps: What to Do Before Signing Up

- Match your trading volume to an account type (FREE, ZERO, FIX, CENT)

- Test the platform via WebTrader or mobile

- Use the education and analytics sections to explore tools

- Join the community — social and copy trading are most useful when engaged

- Track your cost per trade across 5–10 orders — compare vs. your old broker

These tips come directly from what other traders have shared — and form the core of meaningful Gracexfx.com reviews.

No Comment