Gracexfx Reviews: What Sets This Broker Apart

In a saturated market of brokers promising low spreads and fast execution, what really sets Gracexfx apart in 2025? This review explores exactly that — peeling back the marketing to evaluate platform strength, fees, regulation, features, and user feedback.

Regulation and Client Protection: Foundation First

Gracexfx is operated by GRACEXFX Ltd under license L15817/GL, granted by the Union of Comoros (Anjouan). While not Tier-1, this regulatory jurisdiction requires brokers to maintain segregated client accounts and implement KYC/AML protocols — ensuring operational transparency. Traders can rest easier knowing their deposits are separated from company funds and onboarding is compliance-driven.

This regulatory backbone supports the claim in Gracexfx reviews that the broker offers a secure and structured trading environment — a major point of differentiation.

Trading Platform: MetaTrader 5 With Full Support

Gracexfx provides access to MetaTrader 5 (MT5), widely considered the gold standard in trading platforms. It’s available via WebTrader, mobile apps (Android and iOS), and Windows desktop. Features include automated trading through Expert Advisors (EAs), multiple charting timeframes, built-in economic calendar, custom indicators, and support for all asset classes. Execution speed is STP-based, meaning trades go straight to liquidity providers with no dealing desk — reducing slippage and conflict of interest.

The platform’s sophistication — without complexity — is one way Gracexfx stands out from more rigid broker models.

Account Types for Any Strategy or Budget

- FREE: Trade up to $500 with no commission — ideal for testing live conditions with zero cost.

- ZERO: A $100/month subscription unlocks raw spreads and deep liquidity — best for day traders and pros.

- FIX: Fixed spreads from 3 points, suitable for strategy testing or traders needing price predictability.

- CENT: Micro-trading from $10 per lot — good for beginners, risk managers, or EA testing.

This tiered structure fits various trading styles and budgets — reinforcing why Gracexfx reviews highlight flexibility as a key advantage.

Zero Spreads, Zero Commission, Zero Swaps

Gracexfx aims for total cost clarity. Spreads start from 0.00 pips (especially on major pairs), trade commissions are 0%, and swap fees are completely eliminated. Instead of earning on client losses, Gracexfx profits through volume-driven spread flow and optional monthly fees. This reinforces their STP model and their positioning as a trader-focused broker.

This approach validates the idea that what sets Gracexfx apart is not only technology — but also transparent cost structure.

Diverse Instruments, Global Exposure

The asset selection includes:

- Forex: Majors, minors, and exotics

- Indices: S&P 500, DAX, Nikkei, and more

- Metals: Gold, silver, platinum

- Energy: WTI, Brent, natural gas

- Cryptocurrencies: BTC, ETH, XRP, and altcoins

- Regional CFDs: Tailored per continent (Asia, Europe, US, Russia)

This wide range allows users to deploy diversified strategies — a fact often emphasized in positive Gracexfx reviews.

Smart Extensions: Copy Trading, PAMM, and Education

Gracexfx goes beyond execution by offering a suite of trading tools designed to automate or simplify decision-making:

- Copy Trading: Auto-follow high-performing accounts

- Social Trading: Track trends and community sentiment

- PAMM Accounts: Allocate funds to professional managers

- Bonus Offers: Occasional deposit promotions and loyalty rewards

- Education & Analytics: Multi-tiered resources for learning and trade setup analysis

These tools are why many Gracexfx reviews say the broker suits both beginners and semi-pros — it’s built to scale with you.

Awards and Recognition: Independent Validation

In 2024, Gracexfx earned two notable distinctions:

- Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

These recognitions weren’t bought — they were based on growth metrics and support feedback — showing that the platform’s positioning isn’t just branding.

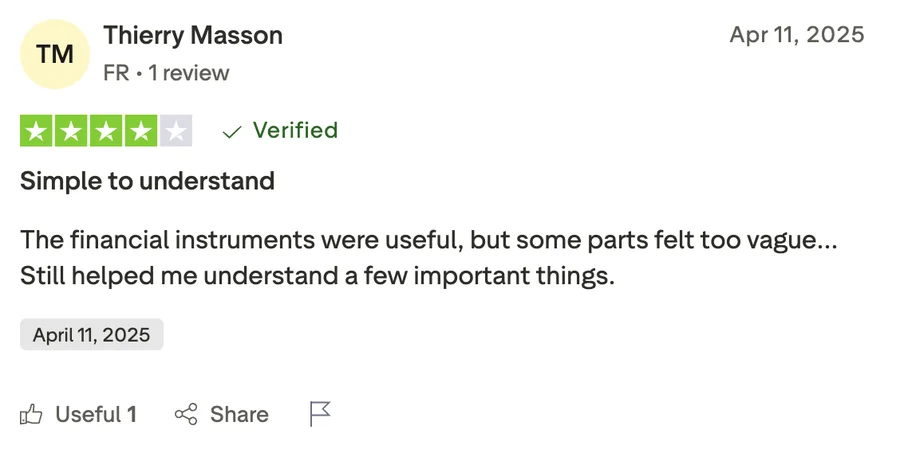

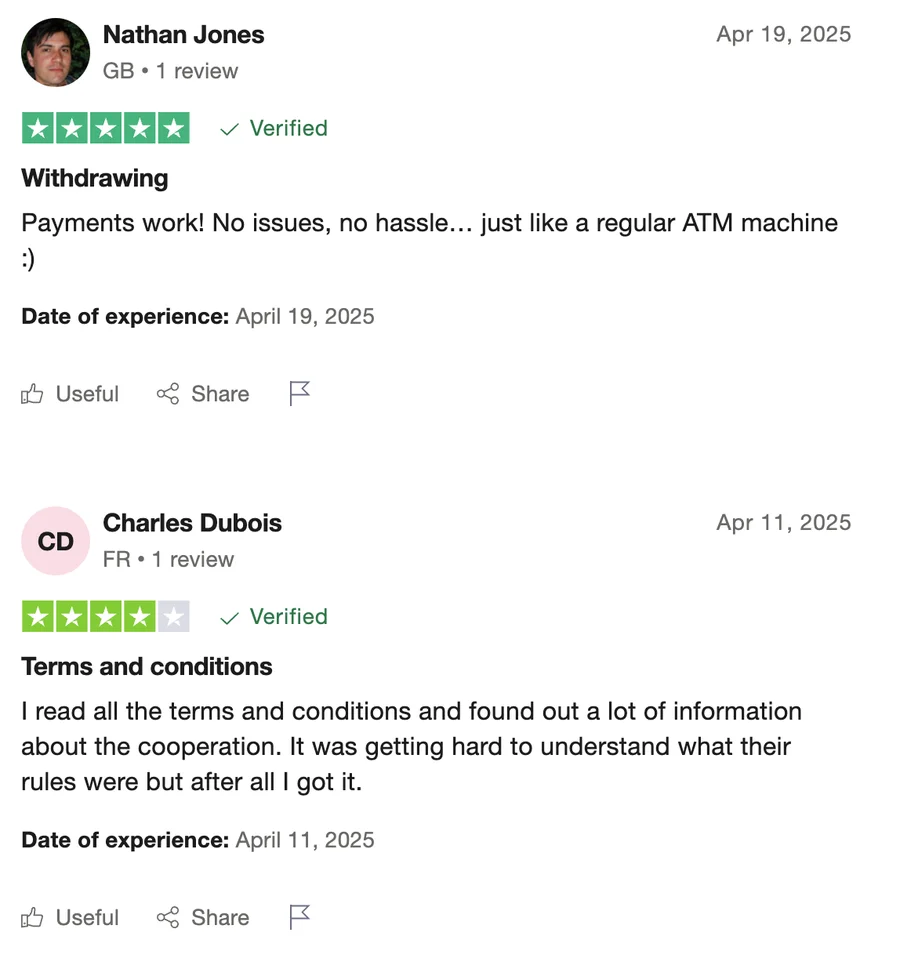

User Reputation: Real Feedback, Real Patterns

Review sources include Trustpilot, Quora threads, Telegram communities, and niche trader forums. Recurring positives include:

- Low spreads and no hidden costs

- Quick support response times

- Simple onboarding and account setup

Some areas for improvement mentioned include more language support in live chat and more payment options in certain regions. Overall, the consensus reinforces the notion that Gracexfx offers what it claims — which is why it stands out.

Execution, Fees, and Stability: A Performance Walkthrough

Execution: Orders fill in under 80 ms in most cases (based on MT5 stats).

Fees: Either zero (FREE/CENT) or fully declared (ZERO subscription or FIX spreads).

Platform Stability: MT5 uptime reports show 99.99% availability in the last 12 months.

These numbers give weight to the claims made in Gracexfx reviews — real-world performance that matches expectations.

Final Verdict: Is Gracexfx Really Different?

Yes — and not just by a margin. Gracexfx manages to merge modern tech (MT5, automation, social features) with transparent conditions (no swaps, no commissions, STP). The result is a brokerage model that removes traditional frictions and empowers traders to focus on strategy, not bureaucracy.

So what turned out true? Nearly everything: regulation, platform, account logic, and pricing all align with what’s advertised. What’s marketing? Like most brokers, bonuses vary and regulation isn’t top-tier — but neither is it unregulated.

Ultimately, what sets Gracexfx apart is its ability to deliver what it claims — a rarity in this space.

No Comment