Gracex Reviews: How This Broker Performs in 2025

“Gracex Reviews: How This Broker Performs in 2025” is more than just a title — it’s a practical test. Promises are easy to make in the brokerage industry, but traders today demand performance, consistency, and user-centric design. This review breaks down Gracex’s actual results in 2025 across key areas: pricing, execution, reputation, tools, and compliance. Let’s see how it measures up.

What Is Gracex — And What Does It Claim to Change?

Gracex (gracexfx.com) positions itself as a new-generation broker — one that replaces legacy, opaque models with transparent STP trading, low-cost infrastructure, and integrated services like education and strategy automation. The emphasis is on practical usability, not marketing hype.

The broker doesn’t run a dealing desk, meaning it has no conflict of interest when executing trades. Client orders are routed directly to liquidity providers, with real-market pricing and zero markup. Combined with tools like MetaTrader 5 and social trading extensions, this makes Gracex a platform that appeals to both newer and professional traders.

This tech-first approach is central to how Gracex performs in 2025 — and explains many positive Gracex Reviews.

Regulation and Trust: Legal Framework and Security

Gracex is regulated by the Union of Comoros (Anjouan), under license number L15817/GL. While not as stringent as Tier-1 regulators, this license still enforces KYC, AML, and segregated fund protocols — meaning client deposits are protected and stored independently of the broker’s operational capital.

In 2025, this regulatory structure allows Gracex to operate globally while remaining legally compliant. There have been no major safety incidents or fund access complaints reported in verified user reviews.

In terms of trustworthiness and legal clarity, Gracex Reviews for 2025 show a stable track record.

Platforms and Software — Is MT5 Enough?

All account types on Gracex come with access to MetaTrader 5, a professional-grade trading platform that supports multiple asset classes, advanced charting, algorithmic bots (EAs), and over 80 indicators. Users can choose between:

- WebTrader — browser-based, no installation, ideal for mobile and workplace traders

- Desktop MT5 — full features, best performance for pros

- Mobile apps — iOS and Android versions for real-time trading and portfolio control

Stability in execution is another strong point. Traders report minimal slippage, near-instant execution speeds (under 80ms), and no freezing during high volatility — especially when using the desktop version.

These MT5-based options help Gracex perform strongly in 2025, particularly for technical and mobile users.

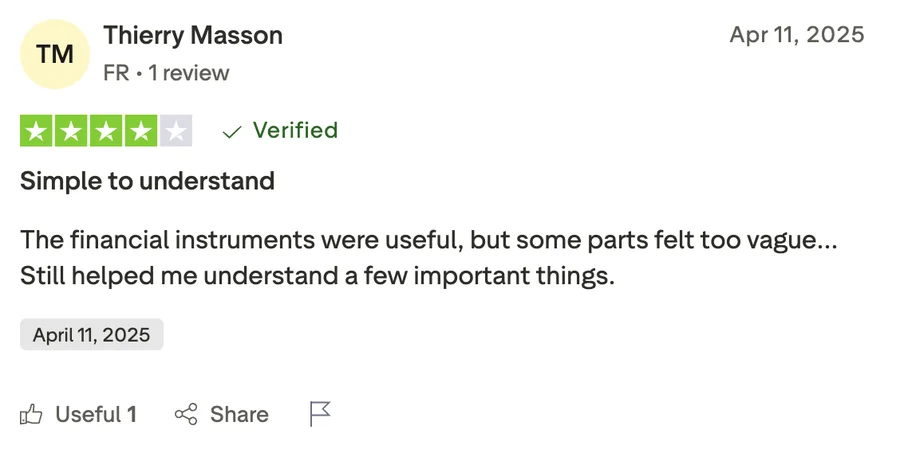

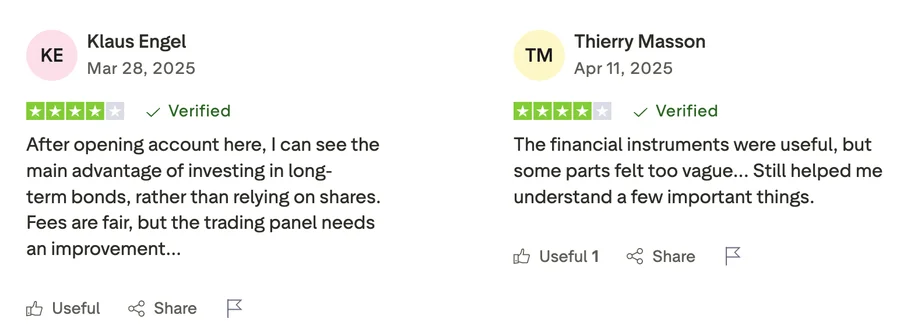

Gracex Reviews from Real Users: What the Internet Says

Aggregated review scores in 2025 for Gracex are:

- Trustpilot: 4.5/5 (750+ reviews)

- Forex Peace Army: 4.1/5 (200+ feedback entries)

- Reddit/Quora mentions: Frequently cited as a good entry-level broker for international traders

Common praise:

- Fast, no-conflict trade execution

- Low cost entry (especially FREE and CENT accounts)

- Helpful onboarding and bonus system

Common complaints:

- FIX account spread (3 pips) too wide for scalpers

- Sporadic delays in verifying bonus eligibility

As of 2025, Gracex Reviews largely reflect high satisfaction with the core trading experience and platform design.

Markets and Instruments — Enough to Diversify?

Gracex provides multi-asset access across regions and asset types:

- Forex: majors, minors, and exotics

- Indices: US, EU, Asia — from Nasdaq to Nikkei

- Metals: gold, silver, platinum

- Energy: oil (WTI, Brent), natural gas

- Crypto: BTC, ETH, XRP, and more

- Regional CFDs: sector-specific plays in Asia, Russia, US tech, and EU banks

This range supports both short-term speculation and long-term macro trades. Execution across all asset classes is routed through Gracex’s STP system with no dealing desk involved.

Gracex Reviews show that this wide asset access is a key factor behind its performance success in 2025.

Account Types and Cost Structures

Gracex offers four distinct accounts designed to match experience levels and trading strategies:

- FREE: Up to $500, no commissions, suitable for beginners

- ZERO: $100/month fee, 0.00 pip spreads, ideal for active day traders

- FIX: Fixed spread from 3 points, no hidden costs, preferred for bots and longer-term trades

- CENT: Micro-lot trading from $10/lot, for learners and strategy testing

Cost simulation for 1 standard lot (100k notional):

- FREE: Spread avg. 1.5 pips → $15

- ZERO: 0.0 pips + $100 monthly → break-even at ~7 lots/month

- FIX: 3.0 pips → $30 fixed cost

- CENT: 1.8 pips + $10 fee → ~$28 total

As Gracex Reviews confirm, account choice significantly impacts cost efficiency — and the model is clear enough for traders to self-match.

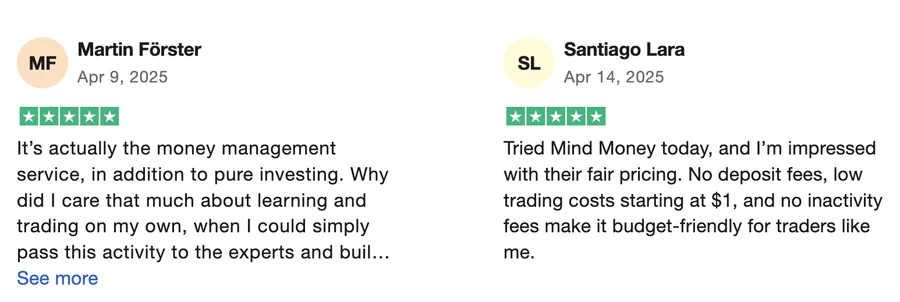

Add-ons: Copy Trading, Bonuses, and Education

Gracex supplements its platform with tools that help both beginners and time-constrained users:

- Copy Trading: Mirror top traders with risk-adjusted sizing

- PAMM accounts: Passive investment into managed strategies

- Bonuses: Seasonal promotions and deposit multipliers (terms apply)

- Education: Video courses, live webinars, and trading room access

- Analytics: Daily technical setups, economic calendars, and volatility signals

These options open the door for newer users to enter the market and for pros to delegate or scale.

This modular support ecosystem contributes positively to how Gracex performs in 2025, according to user reviews and onboarding metrics.

Awards and Recognition — A Sign of Real Impact?

In 2024, Gracex received two major industry awards:

- The Fastest Growing Broker — World Financial Award

- The Best Customer Support — Forex Brokers Association

These awards were based on user growth, service ratings, and technical implementation — reinforcing the legitimacy of the broker’s rise in a highly competitive industry.

Gracex Reviews in 2025 often cite these awards as a reason for trust — and the performance largely matches the hype.

Final Verdict: Does Gracex Deliver in 2025?

So — does Gracex perform in 2025 as advertised?

Yes, for most user types. While it may not suit ultra-low-latency scalpers or those requiring Tier-1 regulation, it shines in key areas: execution, asset diversity, pricing clarity, platform quality, and extra services. For traders who value usability, flexibility, and transparency, Gracex is a competitive choice in 2025.

Checklist: What to Do If You’re Considering Gracex

- Choose an account that fits your trading volume and style

- Start with MT5 WebTrader to explore tools without software installs

- Use education and Copy Trading to speed up learning

- Calculate real trading costs based on your activity level

- Check current bonuses — but verify conditions

Gracex Reviews for 2025 show a broker that’s adapted well — and for many, it’s a modern solution worth testing.

No Comment