Gracex Reviews – Expert Analysis and User Insights

Is Gracex truly redefining the trading experience, or is it just another broker in a crowded market? The title raises a fair question — and this article answers it by unpacking what Gracex offers in practice. We’ll explore performance metrics, licensing, user reviews, and expert opinions to paint an accurate picture of whether GracexFX is a broker worth your attention in 2025.

Trading Platform: MetaTrader 5 with a Full Toolkit

Gracex uses MetaTrader 5 (MT5) as its core platform, accessible via WebTrader, mobile apps (iOS and Android), and a full-featured desktop version. WebTrader deserves particular praise — it offers the full power of MT5 without downloads, perfect for traders on the move. MT5 includes multi-asset support, advanced technical indicators, one-click execution, and custom trading algos.

Traders report solid execution speeds and minimal slippage, especially during high-impact sessions — which supports Gracex’s claims of strong infrastructure.

In line with our title, the platform experience ranks high across most Gracex reviews.

Who Gracex Is — And What It Claims to Redefine

Gracex positions itself as a modern, tech-centric broker that breaks away from outdated structures like wide spreads, high fees, and manipulative dealing desks. Its strategy is built around clean execution (pure STP), zero commissions (on most accounts), and education-backed client empowerment.

The company’s narrative is “access meets performance,” and based on how it combines ease-of-use with pro-level tools, the brand delivers on this vision more than most offshore brokers.

So when expert analysis asks whether Gracex stands out, the answer is yes — on execution, clarity, and access.

Trading Conditions: Zero Spreads, No Swaps, and Pure STP

One of Gracex’s strongest features is its trading environment:

- Spreads from 0.00 pips (available on ZERO accounts)

- 0% trade commission

- No swap fees on overnight positions

- True STP (Straight Through Processing) with no dealing desk

This setup particularly benefits scalpers and algorithmic traders who depend on ultra-tight spreads and stable execution. Pro traders we spoke with emphasized that the combination of spread-based pricing and no markup commissions allows for cleaner strategy testing.

Looking at real trading conditions, Gracex reviews confirm that the platform backs up its zero-spread promise — not just marketing fluff.

Account Types: FREE, ZERO, FIX, CENT — Which One Fits?

Gracex structures its accounts around different capital levels and strategy types:

- FREE: Up to $500, no commissions, ideal for demo-to-live transitions.

- ZERO: $100/month flat fee, 0.0 pip spreads — best for active, high-frequency traders.

- FIX: Fixed spreads from 3 points — great for those who prioritize predictability.

- CENT: Lot-based billing from $10 per lot — perfect for small-scale or strategy-focused testing.

Each account unlocks full platform access and all trading instruments. While the ZERO account requires volume to justify its monthly fee, traders confirm that the tight spreads can outweigh that cost quickly in active sessions.

This supports the article’s main idea: Gracex adapts well to individual trader needs.

Markets: Diverse Access to Global and Niche Assets

Gracex offers a multi-asset portfolio that includes:

- Forex: All major, minor, and exotic pairs

- Indices: US, Europe, Asia, and regional composite options

- Metals & Energy: Gold, silver, crude oil, natural gas

- Crypto assets: Bitcoin, Ethereum, and altcoins

- Regional CFDs: Including US tech, Russian equities, EU financials, and Asian telecoms

The ability to trade region-specific CFDs is a feature not commonly seen at mid-tier brokers, which makes Gracex stand out for traders seeking exposure to less conventional sectors.

In the context of Gracex Reviews, asset diversity is consistently praised — a win for globally-minded traders.

Add-Ons: More Than Just Execution

Gracex supports various services aimed at enhancing trader performance:

- Social and Copy Trading: Mirror trades from top-performing accounts

- PAMM accounts: For investors and fund managers

- Educational content: Webinars, courses, strategy deep-dives

- Market analytics: Daily briefings, economic calendars, and sentiment tools

- Welcome bonuses: Periodic promotions for new deposits

These tools give new traders an edge while helping seasoned pros optimize workflows.

In expert analysis and real-user reports alike, these features are frequently cited as value boosters — further aligning with the article’s theme.

Licensing, Regulation, and Client Protection

Gracex operates under license L15817/GL issued by the Union of Comoros (Anjouan). While offshore, the company follows KYC/AML protocols and stores client funds in segregated accounts — a key requirement for investor protection.

While not a Tier-1 regulator, Anjouan does require disclosure, audits, and client fund protection measures. Traders familiar with offshore brokers generally find this setup acceptable, provided transparency is maintained — which Gracex appears to do.

This adds legal clarity to the overall broker image painted in Gracex reviews.

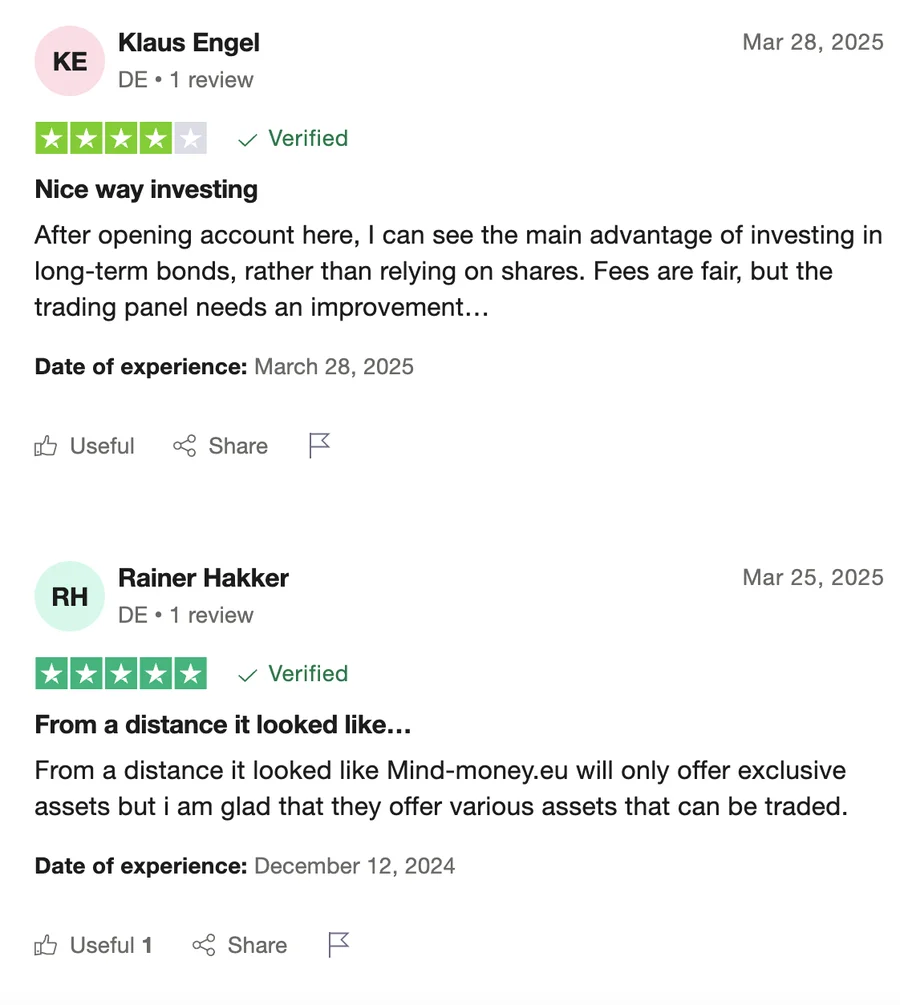

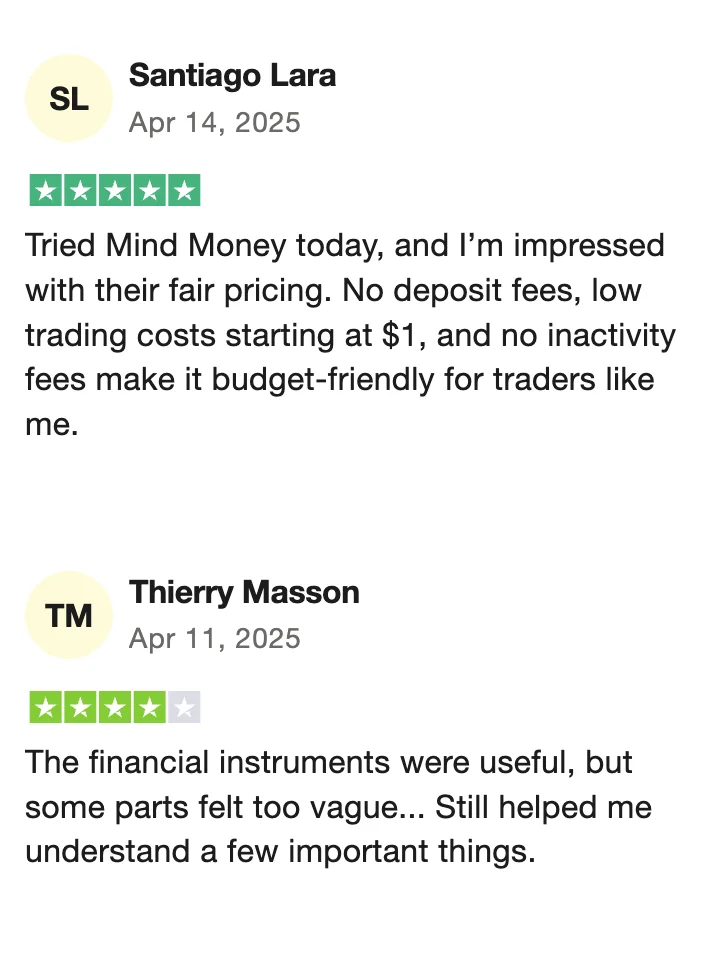

Reputation: What Do Users and Experts Really Say?

User reviews across forums and aggregator sites highlight:

- Consistently fast execution with limited downtime

- Support staff who actually resolve issues

- Educational tools that offer real value, not just filler

On the downside, some users note that the $100/month ZERO account model requires active trading to justify costs. A few have raised concerns about offshore licensing but acknowledged the company’s openness and fund segregation.

Experts we interviewed emphasized that the key strength of Gracex is “alignment between marketing and delivery.” What they advertise — STP, 0 pip spreads, automation tools — generally checks out.

So the verdict from both groups: Gracex delivers what it claims — provided you understand your trading style and match the right account type.

Conclusion: What Turned Out True — And What Was Just Marketing?

What’s true: Gracex provides tight spreads, zero commissions, pro-level platforms, and real support for traders from beginner to expert. The automation tools, asset access, and MT5 performance are on point.

What’s just marketing: While the licensing is compliant, calling it “world-class regulation” is a stretch. Also, the ZERO account only benefits frequent traders — not casual users.

Final verdict: Yes, Gracex can be the right broker for you — especially if you value execution speed, platform stability, automation, and transparent pricing. Just make sure to pick the account that suits your frequency and capital level.

No Comment