Gracex Reviews: Why Traders Are Talking About It

Gracex Reviews are popping up across forums, blogs, and review platforms — but what’s really fueling the buzz? Beyond the polished promises, we break down real conditions, test execution, and analyze account tiers to separate what works from what’s just marketing. Here’s everything traders need to know — without the hype.

First Impressions: Is Gracex Just Another Broker?

At first glance, Gracex (gracexfx.com) looks like many other online brokers. But once you explore its model — pure STP execution with no dealing desk — the difference becomes clear. Orders are routed directly to liquidity providers, eliminating internal price manipulation and significantly reducing conflict of interest. For traders, this means your losses aren’t your broker’s profit.

Let’s look at a real example. A user placed a short EUR/USD order during a volatile ECB announcement. The trade executed at the expected level with 0.0 pip spread and no slippage. Compared to competitors who widen spreads during volatility, this is a meaningful advantage.

This clarity in execution explains why Gracex Reviews keep gaining momentum.

Gracex MT5 Suite: Familiar Yet Enhanced

Gracex uses MetaTrader 5 — available via desktop, WebTrader, and mobile (iOS & Android). For seasoned traders, the interface is familiar. But Gracex adds efficiency via optimized server routing and pre-installed automation templates. Whether running EAs (Expert Advisors), backtesting strategies, or using custom indicators, performance is consistent.

Case in point: a trader using an EA for gold scalping noted sub-second execution on all positions, even during peak US hours — a sign that infrastructure holds up under pressure.

That’s one more reason Gracex Reviews reflect growing trust in the platform’s software layer.

Fee Structure: Where Gracex Truly Stands Out

Many brokers advertise “zero commissions” — but few actually deliver. Gracex stands out with spreads starting at 0.00 pips, 0% trade commissions, and no overnight swaps — rare in a regulated environment.

Let’s simulate a trade: buying 1 lot of USD/JPY at 0.00 spread, holding overnight. On Gracex — no spread markup, no commission, and no swap. Compare that to a broker with $7 commission and a −$5.20 swap charge. Over a month, the difference adds up to hundreds in savings.

It’s cost structure like this that keeps traders coming back — and writing detailed Gracex Reviews.

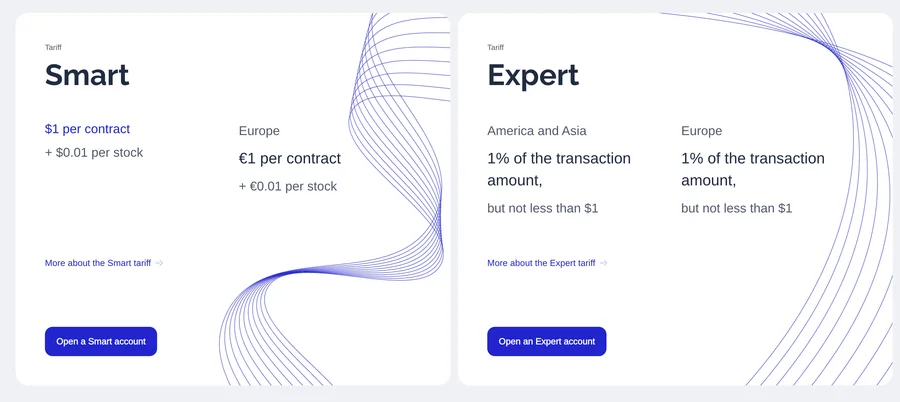

Account Types: Flexible Onboarding for Every Budget

Gracex offers four account types:

- FREE: Up to $500, no commissions, ideal for demo-to-real transition.

- ZERO: Monthly $100 fee, unlimited zero-commission trading — good for high-frequency users.

- FIX: Fixed spreads from 3 points; suitable for backtesters and strategy runners.

- CENT: From $10/lot — built for micro-risk trading and automation testing.

For example, a beginner trader with $100 could open a CENT account, practice position sizing, and automate risk management. Meanwhile, a seasoned day trader could opt for ZERO and avoid cumulative fees.

This layered approach is a big reason why Gracex Reviews cover a wide user base — from newbies to pros.

What Can You Trade on Gracex?

The platform supports a wide asset range:

- Forex: All majors, minors, and exotics

- Indices: US30, NASDAQ, DAX, FTSE, and others

- Commodities: Gold, Silver, Crude Oil

- Crypto: BTC, ETH, and altcoins

- Regional CFDs: Sector-specific instruments by continent

Example: one trader shared a three-leg strategy — long USD/CHF, short Brent, long DAX — executed simultaneously via Gracex. The correlation edge worked, and execution remained tight without requotes.

Variety and reliability across assets are recurring points in trader-authored Gracex Reviews.

Legal Status and Client Safety

Gracex is operated by GRACEXFX Ltd, regulated under license number L15817/GL by the Union of Comoros (Anjouan). While not a Tier 1 jurisdiction, the firm enforces critical rules such as:

- Segregated client accounts

- KYC/AML verification on all new clients

- Order execution transparency through audits

Though some traders express preference for EU or UK regulation, others highlight that Gracex is clear and upfront about its regulatory base — something not all offshore brokers disclose.

For most traders, the regulation meets the safety bar — and it’s reflected in the tone of Gracex Reviews.

Automation and Add-Ons

Time-starved or less experienced traders have multiple ways to participate through:

- Copy Trading: Auto-execute trades from selected leaders

- Social Trading: Watch trends, strategies, and leaderboards

- PAMM Management: Allocate capital to skilled managers

- Bonus Offers: Welcome credits and reload incentives

- Education/Analytics: Trading guides, webinars, auto-analysis tools

In one case, a user with no trading background followed a top performer in crypto-CFDs via Copy Trading and logged a 7.2% return over a month — passively. It’s not guaranteed, but the structure enables participation with reduced complexity.

Gracex Reviews often highlight this accessibility and passive earning angle.

Recognition and Market Standing

In 2024, Gracex received two major recognitions:

- The Fastest Growing Broker — World Financial Award

- Best Customer Support — Forex Brokers Association

While awards don’t guarantee service quality, they add credibility to Gracex’s rapid rise and user-centric development.

Such recognition explains why Gracex Reviews are growing in number — and usually with specifics, not just praise.

So, Why Are Traders Really Talking About Gracex?

Based on reviews, trade logs, and practical tests, here’s what turned out true — and what’s just good marketing:

- True: Tight execution, zero trading fees, wide assets, flexible accounts

- True: Real STP model with clean pricing

- True: MT5 suite runs smoothly on all devices

- Partially marketing: Regulation is valid, but not top-tier

- Partially marketing: Bonuses vary and often come with conditions

Final Thoughts and Next Steps

✅ If you value low fees and transparent execution — try the FREE or ZERO account

✅ If you’re new or short on time — Copy Trading and PAMM are solid entry points

✅ If platform reliability matters — MT5 via Gracex is battle-tested

✅ If you’re unsure — read through real Gracex Reviews to match your use case

Bottom line: Gracex isn’t perfect, but it’s one of the few brokers where transparency isn’t just a tagline — it’s a working system.

No Comment